48+ what is the debt to income ratio for a mortgage

Get Instantly Matched With Your Ideal Mortgage Lender. Ideally lenders prefer a debt-to-income ratio lower.

Prepare Loan Compass

Ad Compare the Best Home Loans for March 2023.

. Ad See what your estimated monthly payment would be with the VA Loan. Web The QM rules began after the housing crisis to keep lenders more accountable and borrowers choosing smarter loans. Your monthly expenses include 1200.

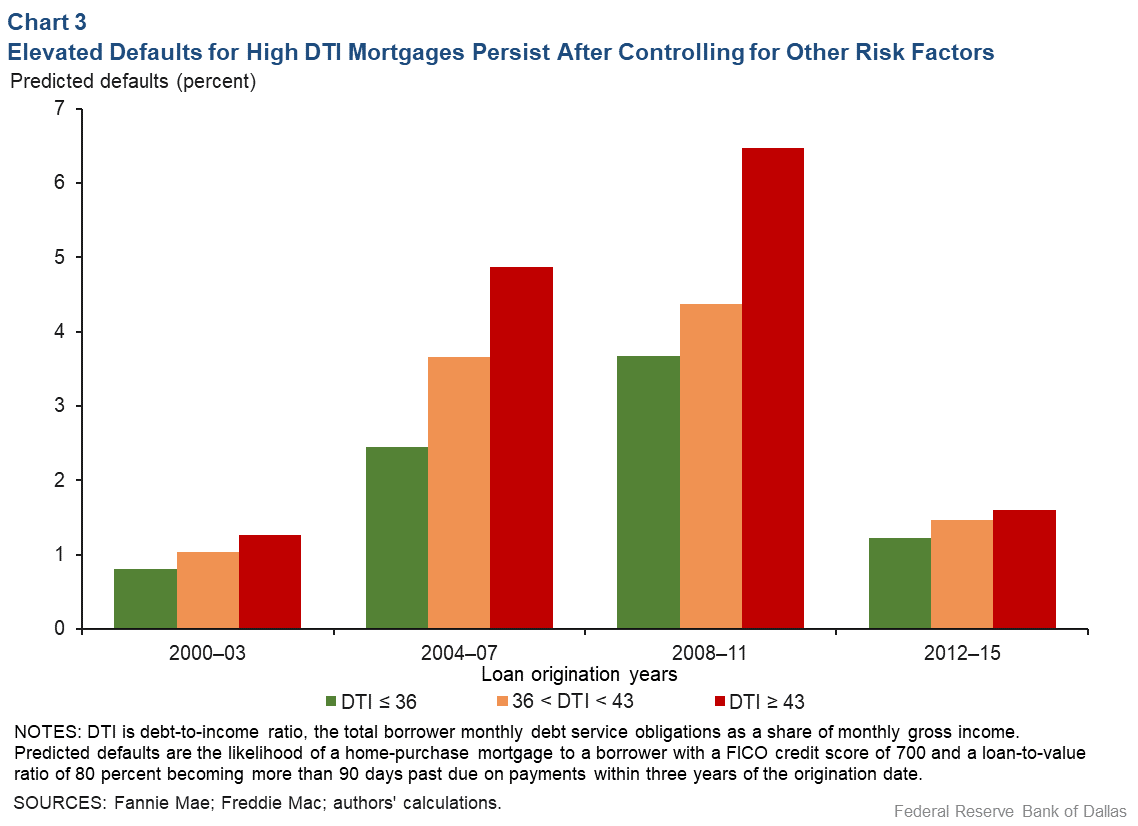

150 Home Equity Line. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. Web Calculating the front-end DTI is easy because the focus is only on the new mortgage obligations.

Apply Get Pre-Approved Today. 500 Credit Card B. Ad See what your estimated monthly payment would be with the VA Loan.

Lock Your Rate Today. Apply Get Pre-Approved Today. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Your mortgage property taxes and. Get Instantly Matched With Your Ideal Mortgage Lender. The ratio helps both you and lenders determine how much house you.

1 2 For example. Web Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income. Once youve calculated your DTI ratio youll want to understand how lenders review it when theyre considering your application.

According to the Qualified Mortgage Guidelines. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. You have a pretax income of 4500 per month.

Lenders look at your new housing payment including principal. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Web Monthly debt payments monthly gross income X 100 DTI ratio For example your income is 10000 per month. For example if your monthly pre-tax income. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Ad Compare Home Financing Options Online Get Quotes. Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Multiply that by 100 to get a.

Save Real Money Today. Web Your debt-to-income ratio reflects the percentage of your monthly income that goes toward debt payments. Lock Your Rate Today.

Web Our standards for Debt-to-Income DTI ratio. Web Debt-to-income ratio total monthly debt paymentsgross monthly income. Lock In Your Rate With Award-Winning Quicken Loans.

Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. Ad Compare the Best Home Loans for March 2023. Web DTI Monthly Debts Gross Monthly Income For example say your debts are as follows.

What Is Debt To Income Ratio Moneytips

What S A Good Debt To Income Ratio For A Mortgage Mortgages And Advice U S News

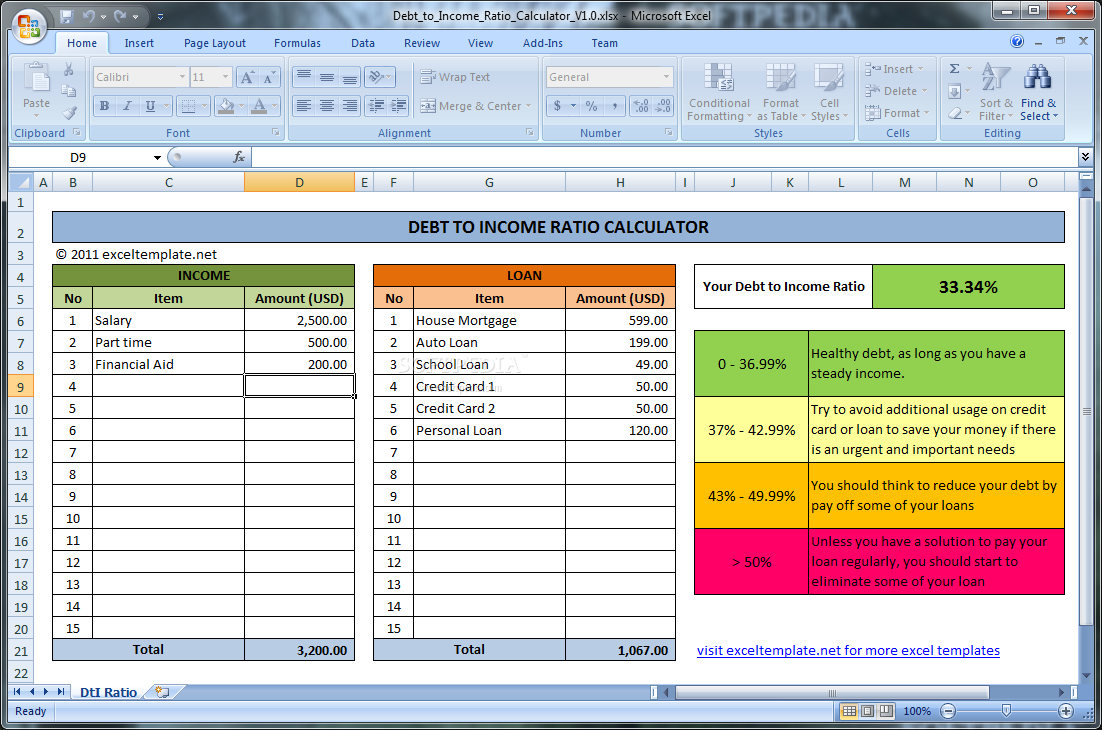

Debt To Income Ratio Calculator 1 0 Windows Download

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

Need A Mortgage Keep Debt Levels In Check The New York Times

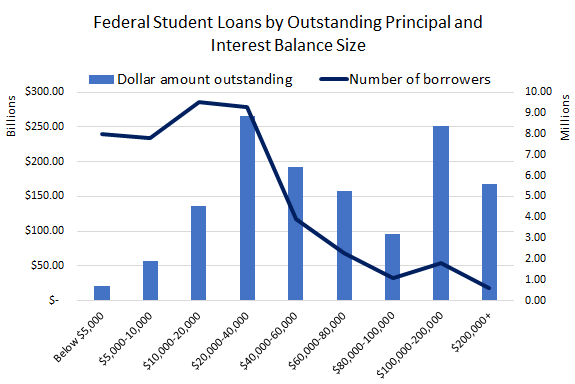

Shorting The Student Loan Bubble With Sallie Mae Nasdaq Slm Seeking Alpha

What S An Ideal Debt To Income Ratio For A Mortgage

What Is Debt To Income Ratio Moneytips

Understanding Dti Debt To Income Ratio Home Loans

What Debt To Income Ratio Is Needed For A Mortgage Tally

Calculating Your Debt To Income Ratio How To Guide

Local Mortgage Choice Brokers In Merimbula Bega Mortgage Choice

Debt To Income Ratio Calculator What Is My Dti Zillow

![]()

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

What Debt To Income Ratio I Need To Buy A Home Big Block Realty

How Your Debt To Income Ratio Can Affect Your Mortgage